🤺 Tencent and ByteDance CEOs Reflect on AI, Chinese LLMs Compete with GPT-4, and Moonshot AI to Raise $200M

Weekly China AI News from January 29, 2024 to February 4, 2024

Hello readers, as we approach the Spring Festival, I wanted to extend my warmest wishes for a prosperous and fulfilling new year to all of you. This week’s newsletter is juicy: Tencent’s Pony Ma and ByteDance CEO have shared their reflections on the AI challenges faced in 2023. In the race to compete with GPT-4, Baichuan AI, iFlytek, and SenseTime have unveiled their latest models. Moonshot AI is raising a $200 million investment from giants Ant Group and Alibaba. Plus, a Chinese startup released a 2B LLM that beats Mistral-7B!!

Tencent and ByteDance CEOs Reflect on AI Development Challenges

What’s New: The chief executives of Tencent and ByteDance have expressed dissatisfaction with their companies’ AI progress compared to their peers.

Tencent CEO Pony Ma in his annual year-end gala speech admitted that Tencent has managed to keep pace with forefront AI players but hasn’t taken a leading position.

Tencent CEO Pony Ma: AI was also a key focus last year, not only within the industry but across the globe. We’ve managed to keep up with the leaders, not necessarily at the forefront, but at least we’re not too far behind. I believe that moving forward, we need to integrate Hunyuan LLMs into various scenarios. In the short term, within the next year or two, I don’t foresee any major AI-native applications. Instead, AI should be incorporated into all of our products for efficiency improvements and the like. I see this as a significant opportunity.

ByteDance CEO Liang Rubo expressed concerns about the company’s mediocrity to achieve breakthroughs. Liang’s critique focused on the company’s late response to OpenAI’s GPTs, as the company launched its chatbot Doubao last August and the bot development tool Coze late last year.

Our organization’s reaction to new opportunities has been sluggish, lacking the sharpness of startups. Our technology review, conducted at the company level every six months, only started to seriously discuss GPT in 2023, while most successful LLM startups were founded between 2018 and 2021.

Despite all this, TikTok’s parent company is likely to achieve over $110 billion in revenue for 2023, with a growth rate of 30%, according to Bloomberg.

Why It Matters: The self-reflection from Tencent and ByteDance, two of the most valuable Chinese tech giants, underscore the intense competitiveness of China’s AI landscape. Their LLMs do not rank among the top 10 in key benchmarks such as SuperCLUE and OpenCompass, and their chatbots have not achieved the popularity of Baidu’s ERNIE Bot or Alibaba’s Qwen. However, the massive user base, product portfolio, and computational capabilities of these two companies suggest that their potential impact on AI should not be underestimated.

Chinese LLMs Rival GPT-4 in Local Language and Multimodal Tasks

What’s New: Last week, three Chinese AI companies announced major upgrades of their LLMs to rival OpenAI’s GPT-4, currently considered the golden standard.

On January 29, Baichuan AI unveiled its LLM Baichuan 3, with over 100 billion parameters and outperforming GPT-4 in Chinese language tasks across benchmarks like CMMLU, GAOKAO, and AGI-Eval. The startup also boasted better performance in medical evaluations compared to GPT-4. Founded by ex-Sogou CEO Wang Xiaochuan in April 2023, Baichuan AI has made Baichuan 3 available on its website.

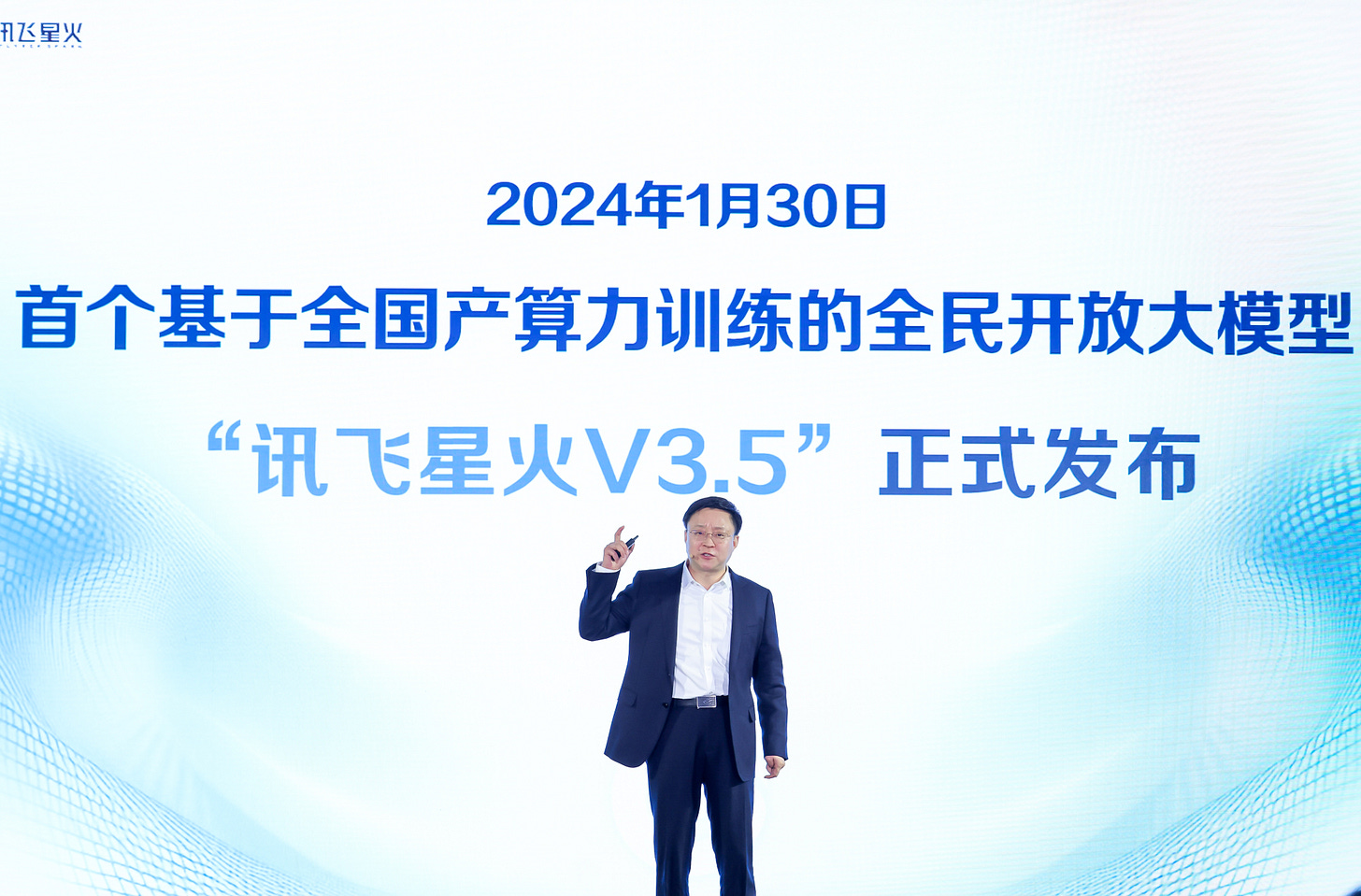

On January 30, iFlytek launched its next-gen Spark Cognitive Large Model V3.5. The company said Spark V3.5 was trained on a fully domestically produced computing platform, co-developed with Huawei. The model is said to surpass GPT-4 Turbo in Chinese language understanding and maths, achieves 96% of GPT-4 Turbo’s coding, and reaches 91% of GPT-4V’s multimodal understanding. iFlyTek also released its Spark Voice Large Model to rival OpenAI’s Whisper.

On February 2, SenseTime unveiled SenseNova 4.0, its upgraded large model system. The Shanghai-based AI company said SenseNova 4.0 matches GPT-4 in overall evaluations and exceeds GPT-3.5, and supports a 128K context window length. It is said to outperform GPT-4 in code generation accuracy (75.6 vs 74.4 on HumanEval), multimodal capabilities (84.4 vs 74.4 on MMBench), and data analysis (85.71% vs 84.62%).

What We Learn: Leading Chinese AI firms are now pitting themselves against GPT-4. Although there is still catching up to do, these Chinese LLMs are claiming to outperform GPT-4 in specific Chinese language tasks and making strides in multimodal capabilities.

Moonshot AI in Talks to Raise $200 Million

What’s New: Moonshot AI, a rising AI startup, is reportedly raising $200 million, with backing from Ant Group and Alibaba Group. The company’s pre-funding valuation reaches $1.5 billion.

Moonshot AI has built a team of 100 to 200 people, led by founder Yang Zhilin, a distinguished Carnegie Mellon University Ph.D. graduate. Yang is renowned for his work as the first author of Transformer-XL and XLNet papers, two innovative LLM architectures that improve on Transformer.

Tell me More: Moonshot AI is known for its long context window techniques. Its chatbot, Kimi Chat, can now process up to 200,000 Chinese characters in context and is open to the public. The recently popular application “Appeasing Simulator哄哄模拟器”, which engages users in mending virtual relationships through communication, is powered by Kimi Chat.

Next Step: Moonshot AI is reportedly preparing to unveil its next-gen LLM that is comparable to GPT-4 next month.

Weekly News Roundup

🌐 Shanghai AI Lab has released OpenCompass2.0, an open-source evaluation system for LLM and multimodal models, providing a one-stop evaluation platform for various models.

🚀 Alibaba Cloud has unveiled a series of AI computing and big data products for the international market at its AI Big Data Summit in Singapore, including a serverless AI service platform and big data products integrated with vector engine technology.

💡 Zhihu-backed AI startup ModelBest 面壁智能 has released its 2B LLM, MiniCPM. The model is said to outperform Mistral-7B in average scores across various mainstream benchmarks in both Chinese and English.

Trending Research

MoE-LLaVA: Mixture of Experts for Large Vision-Language Models

YOLO-World: Real-Time Open-Vocabulary Object Detection

BlockFusion: Expandable 3D Scene Generation using Latent Tri-plane Extrapolation

Thanks for reading. If you’re enjoying this issue, feel free to subscribe to Recode China AI.