👑Inside China’s Race for Next OpenAI, Alibaba Ignites LLM Price War, and Chinese Chatbot Tipping

Weekly China AI News from May 20, 2024 to May 26, 2024

Hello readers, in this issue, I will discuss a recent feature story detailing the rise of China's generative AI startups. Chinese tech giants have started a price war over LLMs, and I’ll discuss its significance (or lack thereof). Also, I'll write about how Alibaba-backed Moonshot AI has introduced a tipping feature to its chatbot, Kimi, which is being hailed as an innovative monetization strategy.

Inside China’s Race for the Next OpenAI

What’s New: Last week, Tencent Tech News released an exclusive feature detailing the rise of China’s generative AI startups over the past year. It offers a rare inside look at the growth of China’s LLM industry.

Six Major Players: Six leading LLM companies have emerged: Zhipu AI, MiniMax, Moonshot AI, Baichuan AI, StepFun, and 01.AI. These startups, all founded before May 2023, are achieving high valuations and unicorn status rapidly, even without products.

If you read my newsletter, you would be familiar with five of them.

Zhipu AI and MiniMax have been key generative AI players for years. Zhipu AI (which I found similar to Anthropic) focuses on enterprise solutions with large corporation clients, while MiniMax has developed multiple popular generative AI apps both domestically and overseas.

Moonshot AI is gaining traction lately, thanks to its wildly popular chatbot Kimi and its rock star founder Yang Zhilin, and reportedly raising new funding.

01.AI and Baichuan AI, founded by two Chinese Internet gurus respectively, recently unveiled their latest models and applications. Both companies built their models on Llama and differentiated on Chinese capabilities.

StepFun, founded by Microsoft veteran Jiang Daxin, remains lesser-known.

Light Years Beyond: The rapid ascent of these startups follows the exit of Light Years Beyond. In February 2023, Meituan Co-founder Wang Huiwen, who returned to the industry to create a Chinese equivalent of OpenAI, founded Light Years Beyond. The startup quickly secured $300 million, 4,000 GPUs, and a talented team of engineers.

However, Wang’s health issues in May led to Meituan acquiring the company and returning funds to investors. With Light Years Beyond suddenly out of the picture, other LLM companies immediately had access to funding.

Club Deals: In China, investors are adopting the “Club Deal” strategy due to the enormous capital required by AI, with single rounds of financing reaching hundreds of millions to billions of dollars. Traditional VC strategies, which involved spreading smaller investments across multiple early-stage startups to mitigate risk, are no longer effective. This means AI startups often have numerous investors sharing the risk, rather than just one or two major backers.

“The classic VC logic is to write checks under $5 million each, spreading $50 million across ten startups to balance risk. But with AI, the check size is large from day one, making Club Deals necessary,” Wang Mengqiu, founding partner of Crystal Stream Capital, explained.

Major Big Tech: Similar to Microsoft and Google, major Chinese tech companies like Alibaba and Tencent are heavily investing in AI startups starting in 2023. Alibaba invested in five of the abovementioned AI startups, while Tencent made its bets on MiniMax, Zhipu AI, and Baichuan AI.

There is a mix of optimism and caution about the future among investors, with some fearing the dominance of big tech in the AI sector.

The Onset of China’s LLM Price War

What’s New: Major Chinese tech companies like Alibaba, Baidu, ByteDance, and iFlytek slashed prices on their LLM APIs last week, igniting an earlier-than-expected price war of LLMs.

How it Works: AI companies typically monetize their LLMs by selling API (Application Programming Interface) access to developers and enterprises. They can integrate LLM’s language processing capabilities with their applications.

LLM APIs allow developers to send text queries to a LLM and receive processed outputs. The pricing for these APIs is often calculated per million tokens. For example, OpenAI’s gpt-3.5-turbo-0125 charges $0.5/1.5 per million tokens for input/output.

Recently, companies like ByteDance, Alibaba, and Baidu have drastically reduced their API prices to attract developers.

Timeline of the AI Price War:

May 6, 2024: DeepSeek, an AI subsidiary of Chinese hedge fund manager High-Flyer Quant, kicked off the price war by reducing the cost of its LLM, DeepSeek-V2, to RMB 1 per million input tokens. The company also offers 5 million tokens for free upon login.

May 11, 2024: Zhipu AI, a Chinese AI startup and a Tsinghua University spinoff, increased the free token limit for new users to 25 million tokens and reduced the price of its GLM-3-turbo, by 80%, down to RMB 1 per million tokens.

May 15, 2024: ByteDance significantly undercut competitors with RMB 0.8 yuan per million tokens for its Doubao model.

May 21, 2024: Alibaba Cloud announced that its Qwen-Long model, a GPT-4 model, now costs RMB 0.5 per million input tokens and RMB 2 per million output tokens. This makes it roughly 1/400th the price of GPT-4.

May 21, 2024: On the same day, Baidu AI Cloud counteracted by making its ERNIE Speed and ERNIE Lite models completely free. While these are not flagship models, they are widely used among Baidu’s offerings.

May 22, 2024: iFlytek announces permanent free access to its Spark Lite API, with its Pro/Max versions reduced to RMB 0.21 per 10,000 tokens.

May 22, 2024: Tencent made its HunYuan-lite model API free and reduced prices for its standard and high-end models.

Why It Matters: The reduced price model primarily applies to model inference of some lightweight language models, not to fine-tuning and large-scale deployment. So these price reductions could lower the barrier for developers to experiment with AI applications, potentially accelerating AI adoption and innovation, but it won’t significantly affect enterprise clients, for now.

Still, the price war indicates a highly competitive market aiming to capture market share and attract more developers. Meanwhile, the intense competition might also force some smaller AI firms out of the market, leading to industry consolidation.

Moonshot AI Introduces Tipping Option for AI Assistant Kimi

What's New: Moonshot AI, a rising Chinese AI startup, recently launched a tipping option called “Cheer for Kimi” for their AI chatbot, Kimi.

Moonshot AI is also raising a new round of funding, according to The Information, reaching an estimated valuation of $3 billion. Tencent will reportedly join this fundraising.

How it Works: The new tipping option offers users priority access during peak times. In March, Kimi experienced temporary disruption due to a sudden surge in traffic.

The service includes six subscription tiers, ranging from RMB 5.2 for 4 days to RMB 399 for 365 days. Subscription time is counted in actual calendar days regardless of usage. Currently, this service is only available on the web version of Kimi.

Moonshot AI told the media that tipping is a way for young people to express their affection to Kimi. Kimi’s user base consists of many young users acquired on platforms like Douyin and Bilibili.

Why It Matters: While tipping is common in open-source software, this move by Moonshot is more about testing user interest than generating substantial revenue. While the revenue generated may be minimal compared to operational costs, it serves as an initial step toward validating the concept of monetizing AI services.

Moonshot AI also recently introduced Kimi+, a professional AI assistant capable of addressing specific problems, similar to GPTs.

Weekly News Roundup

Nvidia is selling its AI chips in China at discounts due to competition from local players like Huawei, with its H20 chip priced over 10% lower than Huawei’s Ascend 910B. (Reuters)

Sixteen leading AI companies pledged on Tuesday to develop AI technology safely amid rapid innovation and regulatory challenges.

The pledge includes U.S. leaders Google, Meta, Microsoft, OpenAI, and Zhipu AI from China, as well as firms from South Korea, and the UAE. (Reuters)

At VivaTech 2024 in Paris last week, Baidu CEO Robin Li said that AI surpassing human intelligence is still more than 10 years away. (CNBC)

Chinese AI startup Baichuan AI unveiled its Baichuan 4 model, saying it’s the most advanced Chinese LLM, which tops SuperCLUE rankings. The company also introduced the Baixiaoying AI assistant, aiming to become an AI super app. (SCMP)

Trending Research

This interesting paper by researchers from Monash University, the University of Macau, and Tencent AI Lab introduces an innovative multi-agent framework based on LLMs. They created a virtual company named TRANSAGENTS, which employs a team of digital agents, including editors, translators, and localization specialists, to tackle the complex task of translating literary works. Although their results score low on traditional metrics, the translations are favored by human evaluators for their cultural resonance and readability.

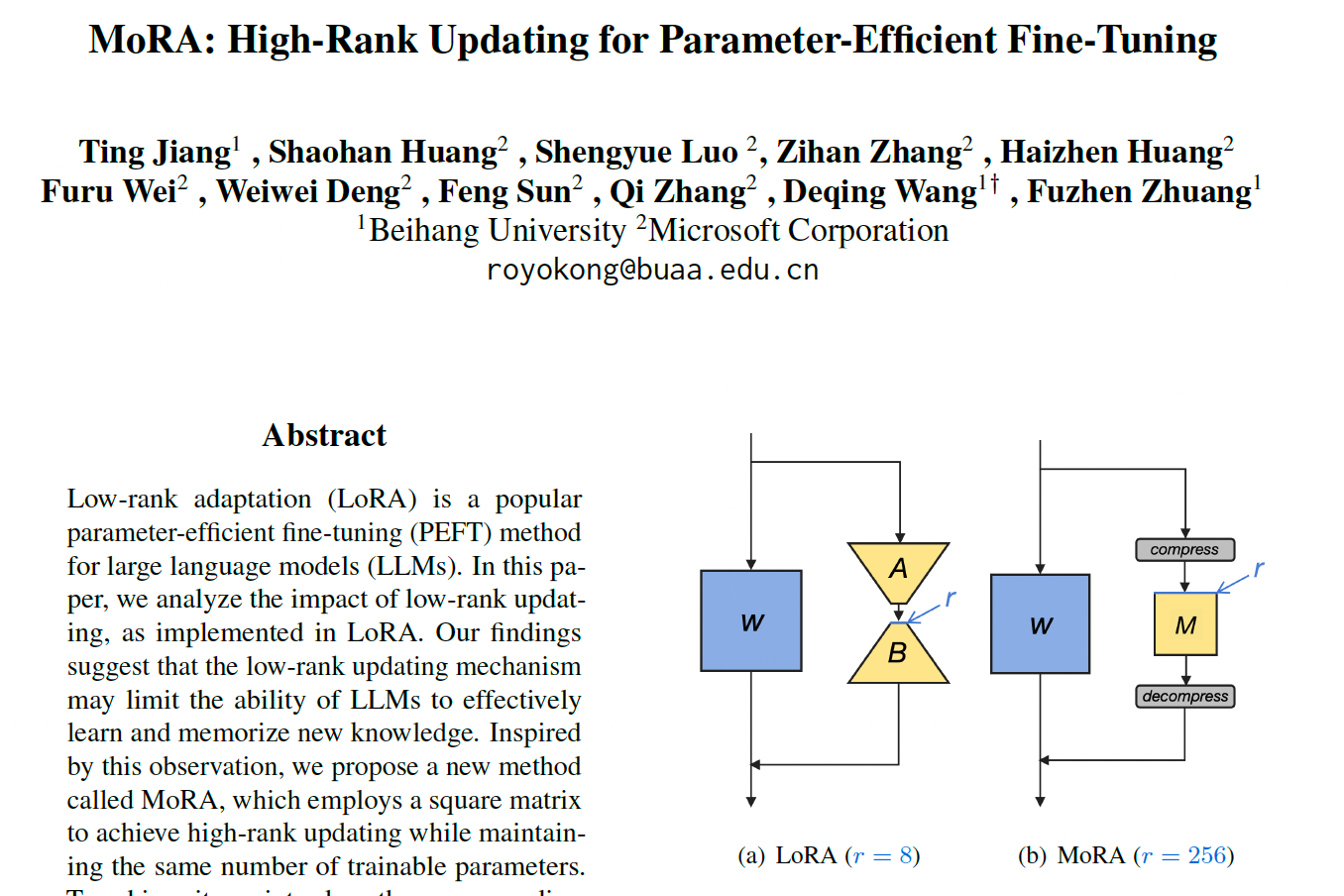

MoRA: High-Rank Updating for Parameter-Efficient Fine-Tuning

Researchers from Beihang University and Microsoft discovered that traditional methods like Low-Rank Adaptation (LoRA) have shown limitations in memory-intensive tasks. The paper introduces MoRA (Matrix Rank Adaptation), a novel approach that employs high-rank updating while maintaining the same number of trainable parameters. The results indicate that MoRA outperforms LoRA in memory-intensive tasks and shows comparable performance in others.