Inside China's Autonomous Vehicle Battleground

A comprehensive review of Baidu, Pony.ai, WeRide, AutoX, Didi Chuxing, and new upstart Momenta

China’s autonomous driving development was on the express lane in 2020. The capital injection pushed autonomous driving startups’ valuations to billions of dollars. Trial robotaxi operations have become a new normal in multiple cities’ suburban areas. Transport regulators have greenlit driverless (no safety drivers in the vehicles) road testing. Highways are expected to be open for autonomous vehicle testing, joining a total of 2,000 km of approved roads.

There are multiple factors contributing to the massive boon of China’s autonomous driving tech:

Most companies are stepping from close-area testing to trial operation on public streets, overall raising awareness through the public.

COVID-19 accelerates future mobility solutions.

The government-led new infrastructure steers autonomous vehicles into the fast lane.

The electric vehicle investment craze pushes the demand for advanced driver-assistance systems.

Others…

This article will offer an inside look at major China’s autonomous vehicle players: Baidu Apollo, Pony.ai, WeRide.ai, AutoX, Momenta, and Didi Autonomous Driving. We will discuss OEMs like Geely and SAIC, new EV upstarts like NIO and Xpeng, and autonomous truck startups like Inceptio.ai in the following issues. Stay tuned.

Baidu (Apollo)

China’s Waymo: There is a clear dominant player in the U.S. and China market respectively. In the U.S., it's Waymo. In China, Baidu Apollo. Baidu Apollo is similar to Waymo:

the first Chinese company that spearheaded autonomous driving development (in 2013)

many of its former talented engineers and researchers laid the foundation of China’s autonomous driving development and later started their own ventures

currently leads China’s autonomous driving development in terms of test mileages (7 million km), licensed plates (199), and the number of robotaxi programs

the only company that obtains driverless permits in both China and U.S.

Baidu will spin off Apollo one day.

The business model of Baidu Apollo is however different from Waymo’s. It wants to build a so-called “Android for Auto”, empowering other OEMs and ride-hailing businesses with its autonomous driving system. That’s why in addition to robotaxi services, which is fully open in three Chinese cities, Baidu Apollo is also doubling down on ADAS, including a highway pilot system and a valet parking system.

While Waymo doesn’t make cars, Baidu has drawn its ambitious electric vehicle blueprint. Its stock price almost tripled in 3 months because it announced a new electric vehicle company in a strategic partnership with China’s top carmaker Geely. The first vehicle model is expected to be launched in 3 years.

Smart traffic: Baidu promises to roll out 3,000 robotaxis in the next 3 years across 30 cities, but right now the company has only 500 vehicles. To expand its robotaxi fleet without burning too much cash, Baidu is seeking alternatives to monetize its tech. It decided to ride on the wave of China’s new infrastructure push and partner with Chinese cities to develop a so-called Mobility-as-a-Service, aiming to transform traffic infrastructures with smart roadside cameras, AI-powered traffic lights, and cloud control centers. Baidu promises to alleviate traffic congestion in the short-term and eventually build a V2X network so vehicles can communicate with the roads and each other. Last year, Baidu signed a $70-million deal with Guangzhou.

Vision-based: Baidu is known as a heavy LiDAR adopter and also an investor of Velodyne and Hesai, a Chinese LiDAR maker. However, its latest autonomous vehicle - FAW Hongqi EV - has only one 40-line LiDAR. In comparison, Waymo’s Chrysler Pacifica has one 360 LiDAR on the top of the vehicle and two perimeter LiDARs mounted at the front and back of the vehicle. The much cheaper cost is a clear advantage that allows Baidu to scale its fleet, but the challenge is Baidu must be really good at vision algorithms.

Pony.ai

China’s top AV startup: China’s autonomous driving industry has reached a consensus that Pony.ai and WeRide.ai, whose founders are both ex-Baiduers, are the best two startups only trailing Baidu. Pony.ai is a money-bagger: the company's total funding has amounted to $1.1 billion in less than 4 years at a post-money valuation of $5.3 billion.

Geeks: Pony.ai Co-founder & CEO James Peng was the No.2 of Baidu Apollo before he left for his own venture. CTO Tiancheng Lou is known as the youngest T-10 engineer of Baidu and a coding master. Many early recruits of the startup are pompous genius coders, geeks.

Robotaxis + Truck: Pony.ai is also copying Waymo: not only it operates trial robotaxi programs in China (Guangzhou) and U.S. (Irvine), it also forays into the autonomous truck business. Its robotaxi fleet has driven 4.5 million km in testing and been providing ride-hailing service for over 2 years within an area of 200 square km in Guangzhou’s Nansha district.

Pony.ai just released its latest autonomous driving system PonyAlpha X, integrated into a Lexus RX450h (the car looks amazing). The road test video looks incredibly impressive, especially how the vehicle handles complex road scenarios at night in urban areas. The only concern is its latest robotaxi is equipped with four LiDARs (maybe one 64 and three 40?), which is an expensive sensor suite and difficult to scale.

It may take another 3-5 years to see a large-scale deployment and commercialization of robotaxis. To make a margin, safety drivers must be removed, but Pony.ai hasn’t unveiled updates in fully driverless testing - either driverless permits in California or China.

While operating its robotaxi services, Pony.ai is also supplying its technology to automakers. However, current passenger vehicles can’t afford the L4 sensor suite. It’s still unknown what advanced driving systems Pony.ai will offer.

WeRide.ai

A close call: The turnaround of WeRide.ai is an incredible story in the history of the autonomous driving industry: founded by Baidu Apollo’s veterans in 2017, WeRide.ai, formerly known as JingChi, was once the most promising AV upstart. It successfully completed its first open road autonomous driving testing in only 81 days and put a prototype through Silicon Valley rush hour traffic two months later, then attracted a Series Pre-A funding of $52 million from investors like NVIDIA.

Then in December 2017, Baidu filed a suit accusing JingChi of infringement on its commercial secrets, echoing the 2017 Waymo vs Uber dispute. JingChi Co-founder Wang Jin left the company in the following months and Baidu dropped the lawsuit. CTO Tony Han took up the CEO role and rebranded the company as WeRide.ai.

2018 was tough for WeRide.ai. While Pony.ai reported a Series A Funding of $214 million in July, WeRide.ai raised money from Renault in October 2018 without disclosing the exact amount in its Chinese PR (the Crunchbase notes $80 million).

However, 2 years later, WeRide.ai secured $310 million in Series B funding in a push to commercialize its technology. As of July 2020, WeRide.ai’s vehicles have driven 4 million km in testing and obtained driverless test permits in Guangzhou. A video of WeRide.ai’s vehicles navigating through an urban village of Guangzhou — full of narrow streets and traffic chaos — made headlines. Says CEO Tony Han, WeRide.ai aims to launch driverless robotaxi operations in 2023.

Autonomous minibus: What’s noteworthy is WeRide.ai’s Series B funding is led by Yutong Group, China’s leading commercial vehicle manufacturer that specializes in buses and construction machinery. WeRide.ai will team up with Yutong to develop autonomous minibuses, city buses and other commercial vehicles. It also launched a trial operation of mini robobuses in Guangzhou starting Jan 15. Autonomous truck is also under its radar.

AutoX

Professor X: AutoX was founded in 2016 by Xiao Jianxiong, also known as Professor X. A respected professor at Princeton University and a top-tier expert in 3D deep learning, Xiao earned his spot in MIT Technology Review’s “Innovators Under 35” list in the Entrepreneurs category.

AutoX experienced rapid early-stage growth: it completed its first autonomous road test within 60 days, was the first Chinese startup that obtained CA DMV Permit, and received investment from China’s top automaker SAIC Motor in 2017.

Camera -> LiDAR: In the beginning, AutoX took a path different from the industry’s common practice. It bet on cameras solely aiming to offer cost-effective solutions. With Xiao’s advanced computer vision expertise, in 2017, AutoX developed its first self-driving car in six months with seven cameras costing a total of just $500. However, the company soon realized LiDAR is a must for Level-4 robotaxi and revamped its vehicles in the following years.

Great PRs, slow funding: AutoX has made some great PRs in 2020: it’s the first Chinese company that gets approval to test driverless permit by California DMV, but it only has one vehicle permitted to test on the street around its US office; the company also claimed it’s the first Chinese company that tests on public roads without safety drivers or remote operators, but traffic authorities in Shenzhen, where the company is headquartered, said AutoX never received any test permit or licensed plates.

AutoX was pressured to showcase its advances in robotaxi because the company lagged behind its rivals like Pony.ai and WeRide.ai, which have both secured hundreds of millions in funding. In 2019, AutoX raised $100 million in Series A funding from Plug and Play, Alibaba, and Dongfeng Motor Group. The company had been seeking new funding over the past year but got no luck. With limited commercialization capability, AutoX will be in serious trouble if it can’t secure fundraising in another six months.

Momenta

$500M: Momenta, a five-year-old autonomous driving company, recently raised massive funding of $500 million, with its total funding reaching over $700 million. The investor lineup is shimmering — Toyota, Daimler, Bosh, and SAIC — a recognition of Momenta’s ADAS technology. Tencent and Jack Ma’s Yunfeng Capital have also joined the investment, which is rare.

Microsoft & SenseTime veteran: Momenta was founded in 2016 by Cao Xudong, a former scientist of Microsoft and SenseTime, a top Chinese computer vision developer. Momenta bets on camera-based ADAS software from the beginning and uses deep learning-based algorithms for perception.

From Tesla to Aurora: Momenta’s business model is pretty clear and consistent: they are aiming at fully autonomous driving by gradually improving their ADAS through deep learning algorithms and huge collections of data. Momenta has developed its Mpilot (Momenta pilot systems for highways, parking, and urban), an equivalent of Tesla’s L2 AutoPilot/FSD, for automakers to power their passenger vehicles. CEO Cao boasts Mpilot is 10 times better than the performance of Tesla’s AutoPilot/FSD in terms of disengagement metrics. Momenta is also developing its camera-based HD Maps software through crowdsourcing.

At the same time, Momenta is building a robotaxi service called Momenta GO, which has launched trial operations last year in Suzhou, where Momenta is headquartered. Momenta is planning to leverage its data collection and gradually improving systems from Mpilot to empower Momenta GO (which is different from Baidu Apollo’s top-down approach). Momenta is positioning itself as a Tier-1 and Tier-2 supplier.

Didi Autonomous Driving

China’s Uber ATG: Didi Chuxing, known as China’s Uber, first unveiled its autonomous driving initiative in 2016 and established a US-based research center focused on autonomous driving in 2017. In 2019, Didi Chuxing upgraded its autonomous driving unit to an independent company called Didi Autonomous Driving, which later raised a total of $800 million in funding over 2 rounds. Just lately, Didi Autonomous Driving is reportedly planning to raise as much as $500 million at a valuation of $6 billion, slightly higher than Pony.ai.

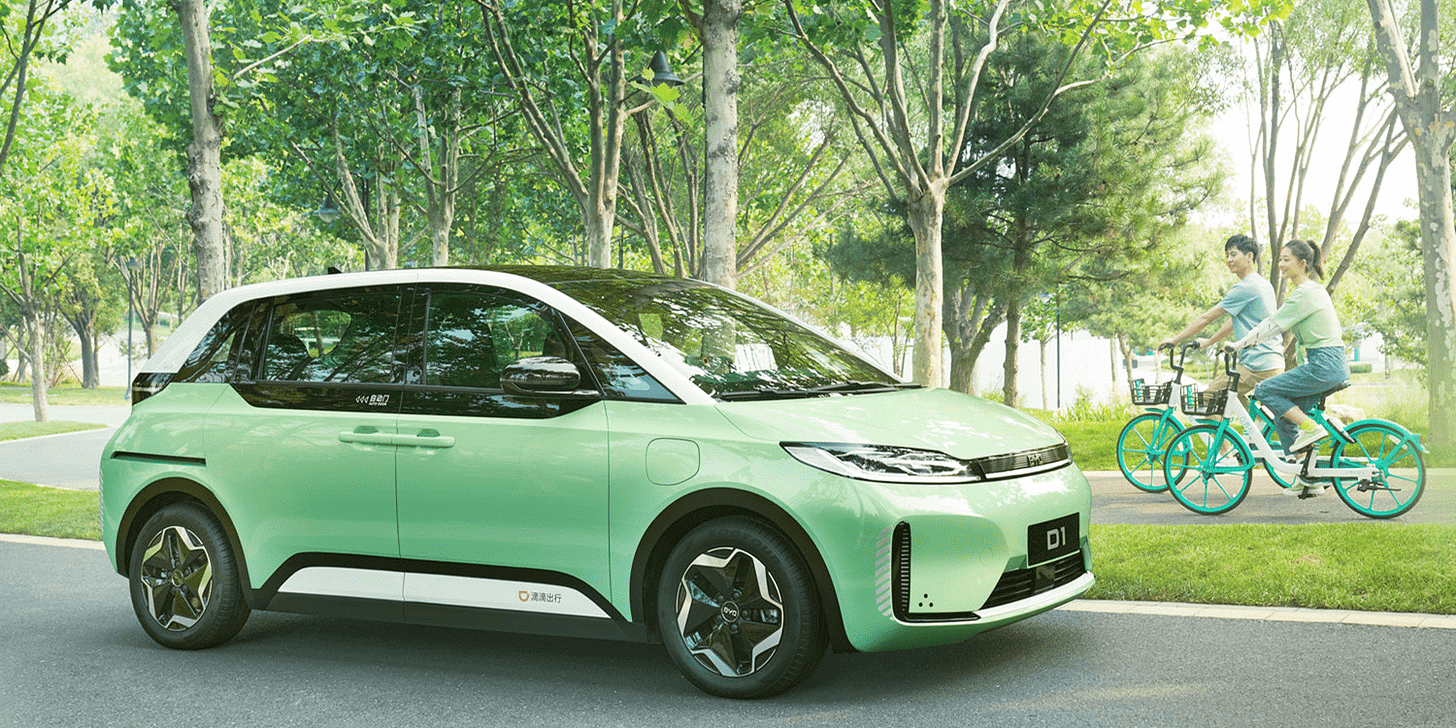

1 million: Didi Chuxing promises to operate over 1 million autonomous vehicles by 2030. In November 2020, Didi Chuxing and China’s top EV maker and battery developer BYD had teamed up to unveil the first electric car designed exclusively for ride-hailing services. Over 1 million D-series EVs will be rolled out in 2025 and be equipped with fully driverless technology in 2030.

Advantages and Challenges: Didi Chuxing operates the largest ride-hailing network in China, with over 50 million ride orders placed every day. The company has abundant data generated by ride-hailing users as well as rich application scenarios for autonomous driving technology.

A dominant ride-hailing giant in China, Didi Chuxing hasn’t made profits yet, however, so it heavily relies on fundraising and foreseeable IPO to raise capital. Unlike Uber, whose food delivery business is growing significantly, Didi Chuxing hasn’t built a second revenue driver. So financially it’s unwise to double down on cash-burning self-driving business without any short-term return.

What’s more concerning is Didi Chuxing hasn’t demonstrated any strong evidence that its autonomous driving technology can catch up with rivals. Its trial robotaxi operation in Shanghai is a disaster with so many human interventions facing simple traffic scenarios. It never ranked at the top of any performance benchmarks, such as the California DMV disengagement report, or test mileage and driverless permits in China.

We may have a better understanding of Didi Chuxing’s autonomous driving development after the company submits its prospectus.