👨🏻🏫Huawei Claims AI Chips Surpass Nvidia's A100, Chinese AI Apps Break into the US, and Tesla FSD Intensifies China's ADAS Competition

Weekly China AI News from June 17 2024 to June 23, 2024

Hi, this is Tony! Be sure to read until the end—the robodog video is incredible!

Three things to know

Huawei said its Ascend 910B AI chips outperform Nvidia’s A100 in training certain LLMs.

Chinese AI applications have gained traction in the U.S. market.

While still in the process of entering the Chinese market, Tesla’s FSD has already increased competition in China’s ADAS industry.

Huawei Says Ascend 910B Chips Outperform Nvidia A100 in AI Model Training

What’s New: Huawei executives have been quiet about the performance of the Ascend 910B AI chip since U.S. sanctions limited the company’s access to advanced semiconductor tech and manufacturing.

However, at the recent 2024 World Semiconductor Conference, Wang Tao, COO of the Jiangsu Kunpeng-Ascend Ecosystem Innovation Center, revealed that Ascend 910B chips now surpass Nvidia’s A100 in training certain large language models (LLMs) with hundreds of billions of parameters. Nearly 50% of China’s LLMs are now trained using Ascend AI chips, according to Wang.

How It Works: The Ascend 910B chip was reportedly developed by Huawei in 2022, and manufactured by U.S.-sanctioned Semiconductor Manufacturing International Corporation (SMIC).

According to Wang, the chip can achieve up to 1.1 times the training efficiency of Nvidia’s A100, the older generation AI chip released in 2020. In training models like Meta’s Llama and BloomGPT, Ascend AI’s training efficiency is better than Nvidia A100, and up to ten times better than other domestic competitors.

iFlytek, a Chinese voice technology and education tool company also sanctioned by the U.S., used a cluster of ten thousand Ascend AI chips to train its Spark LLM.

Huawei has built AI computing centers in 20 cities across China, with a total computing power of 2500 petaflops.

Why It Matters: Huawei’s Ascend AI chips are crucial as the primary domestic choice for LLM training in China. This development is part of China’s plan to promote technological self-reliance, shielding the country from further U.S. restrictions on cutting-edge technology.

Still, there is a long journey ahead for Huawei to match the top chip developer in the U.S. According to a recent report from the Center for Security and Emerging Technology (CSET), a research organization within Georgetown University, only 75% of the advertised performance increase is due to actual hardware improvements. Additionally, the number of active AI cores was reduced in the 910B series, likely due to poor yields or limited SMIC 7nm fabrication capacity.

One More Thing: At the Huawei Developer Conference 2024 (HDC 2024), Huawei’s Executive Director and Huawei Cloud CEO Zhang Ping’an unveiled the latest in their foundation model series, Pangu Model 5.0.

The Pangu 5.0 series includes models ranging from billions to a trillion parameters, supporting applications from smartphones to complex enterprise-wide and cross-domain tasks.

Pangu Model 5.0 also supports multiple modalities, including text, image, video, radar, infrared, and remote sensing.

Chinese AI Companies Expand Globally with New Apps

What’s New: The Information recently reported that Moonshot AI, an Alibaba-backed startup worth $3 billion, is entering the U.S. market with new AI products like a role-playing chat app called Ohai and a music video generator called Noisee. Another Chinese AI startup, MiniMax, is already seeing success with its consumer application Talkie, an AI chatbot with 11.4 million monthly active users.

TechCrunch previously noted that the two most popular AI education apps in the U.S. are developed by Chinese companies.

How it Works: The global market, particularly the U.S., offers more opportunities with better monetization potential and relatively relaxed regulations. With a high valuation of $3 billion, Moonshot AI is under pressure to develop a viable business model by creating consumer-facing apps.

Additionally, a growing number of Chinese entrepreneurs are starting their businesses outside of mainland China. For instance, HeyGen, a digital avatar company originally from Shenzhen, relocated to the U.S. and recently raised $60 million at a valuation of $500 million. Similarly, Genspark, an AI search startup founded by former Microsoft and Baidu executive Eric Jing, raised $60 million at a valuation of $260 million.

Why It Matters: For Chinese entrepreneurs building globally available AI apps, it is both the best and worst of times.

The success of TikTok and Shein has validated the competitiveness of Chinese-owned apps, which leverage advanced algorithms, sophisticated product designs, and aggressive marketing strategies to stand out.

Chinese AI entrepreneurs, many of whom have studied abroad and worked for multinational franchises, have bigger ambitions and global visions. However, these apps face increasing scrutiny in the U.S. market due to geopolitical tensions and national security concerns.

China’s ADAS Industry Heats Up as Tesla FSD Nears Market Entry

What's New: China’s advanced driver assistance software (ADAS) sector gained renewed momentum, with major players like BYD, NIO, and Xpeng making strategic adjustments in their ADAS departments.

The adjustment is partly due to rumors of Tesla Full Self-Driving (FSD), its ADAS feature, entering the Chinese market, which many analysts view as a potential disruptor. Bloomberg last week reported that Tesla has received approval to test its advanced driver-assistance system on some Shanghai streets. Reuters also reported Shanghai is allowing 10 Tesla vehicles to carry out tests of the company's most advanced autonomous driving software to pave the way for its rollout in China.

How it Works: BYD has restructured its smart driving research center. The Chinese EV giant has established a dedicated unit, called Tianxuan Development Department, to improve its self-driving capabilities.

NIO has merged its perception and planning teams into a “large model” team, signaling a shift towards end-to-end solutions. Xpeng has also made strategic hires, bringing in an executive from Alibaba’s Damo Academy to lead user experience and operations in autonomous driving.

Chinese automakers are increasingly adopting end-to-end solutions as the Tesla FSD V12 software update adopts “an end-to-end neural network trained on millions of video clips,” which means the vehicle’s control is handled by neural nets rather than hand-coded rules.

For instance, Xpeng introduced its neural network XNet, planning model XPlanner, and LLM XBrain in May 2023. NIO and Li Auto are also moving towards end-to-end solutions, which integrate perception, planning, and control into a single system. Baidu in May released a foundation model for autonomous driving, called ADFM, that can power both L4 robotaxis and L2 ADAS.

Why It Matters: The push towards end-to-end solutions represents a significant shift in autonomous driving tech. Traditional systems separate perception, decision-making, and control into distinct modules. End-to-end models aim to learn through massive data training. Tesla FSD V12, praised by many users as “the biggest step forward,” demonstrates the effectiveness of end-to-end solutions.

The entry of Tesla FSD in China could accelerate this trend. For now, Tesla’s compliance with Chinese data security regulations, partnerships with Baidu on maps, and the potential for new pilot programs signal readiness for market entry.

Weekly News Roundup

The U.S. government has proposed rules to restrict certain investments in China’s AI and tech sectors to safeguard national security, with a focus on semiconductors, quantum computing, and AI, while allowing exceptions for transactions in the U.S. national interest. (Reuters)

A 17-year-old vocational school student from China, Jiang Ping, has garnered widespread attention and support for outperforming AI and students from top universities in the Alibaba Global Math Competition. (NBC News)

Apple is reportedly in talks with Chinese AI developers, including Baidu, Alibaba, and Baichuan AI, to comply with local regulations and roll out its AI features. (Wall Street Journal)

Kuaishou’s AI video generation model Kling launched two new features, Image to Video and Video Extension.

Baidu’s new generative AI product, Chengpian橙篇, now supports generating long texts of up to 100,000 words and offers multi-modal editing capabilities.

Trending Research

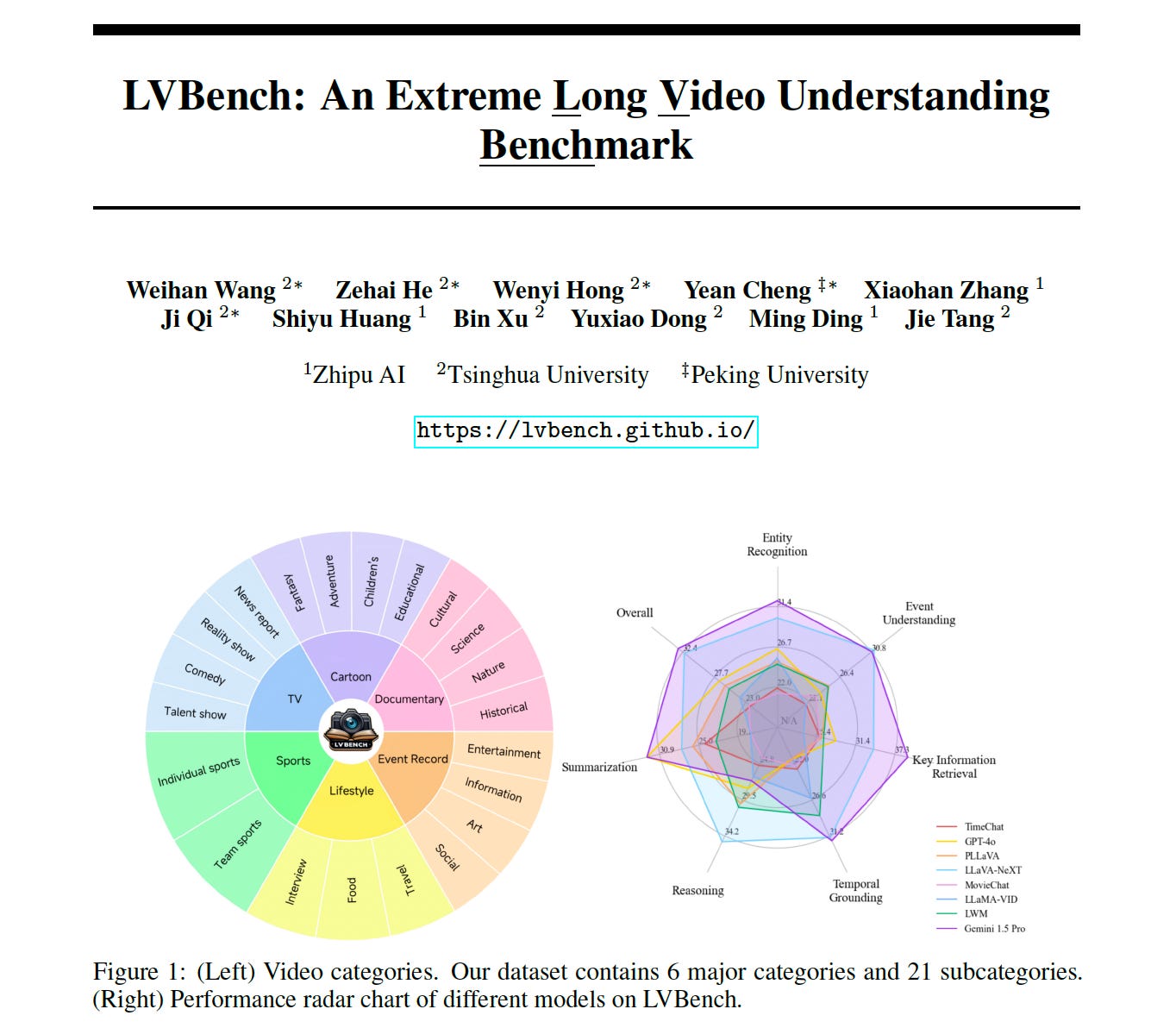

LVBench: An Extreme Long Video Understanding Benchmark

Researchers from Zhipu AI, Tsinghua University, and Peking University, introduced a new dataset and evaluation benchmark called LVBench aimed at advancing the understanding of long videos. This paper aims to address the limitations of current multimodal models in dealing with videos that span several hours.

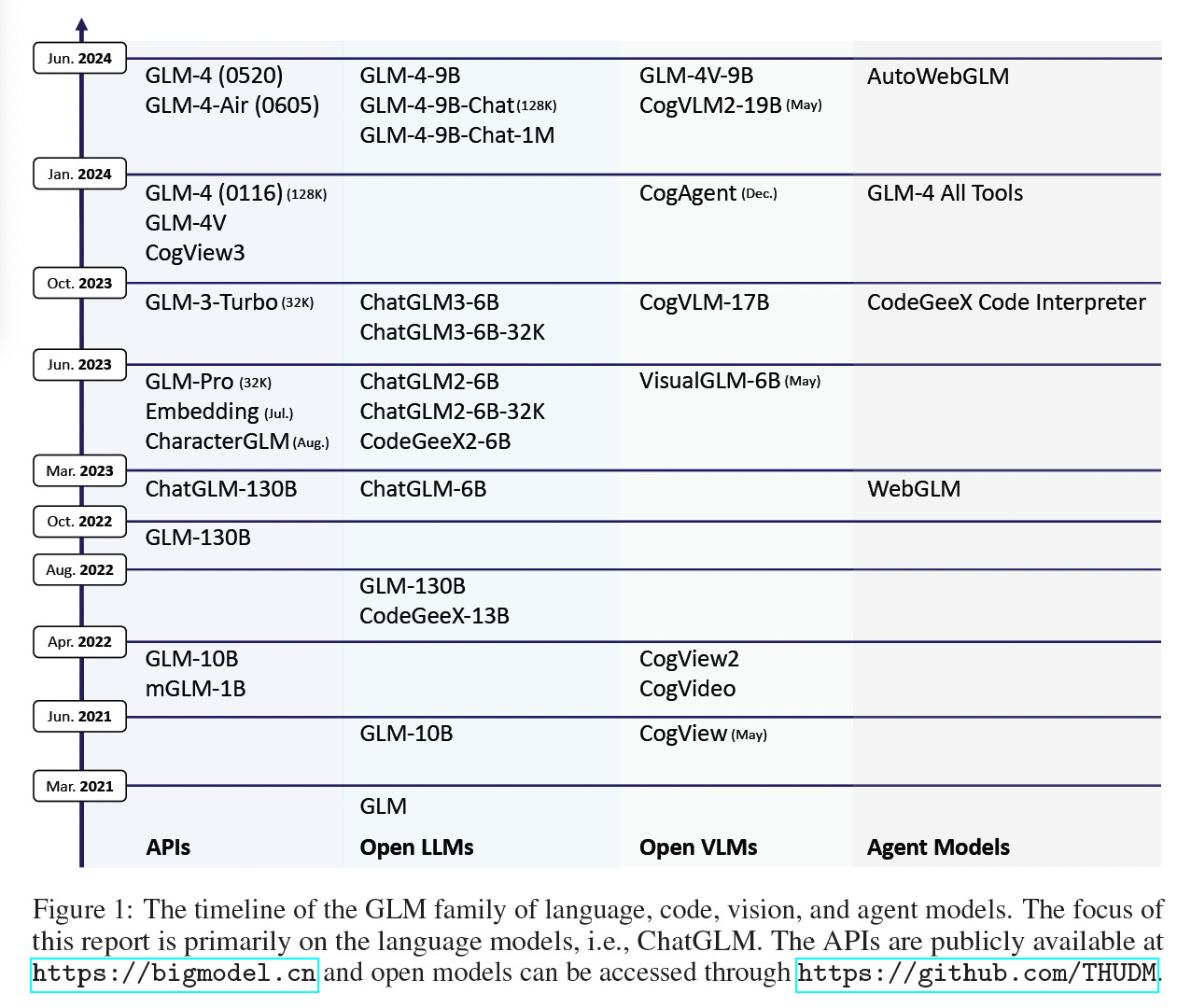

ChatGLM: A Family of Large Language Models from GLM-130B to GLM-4 All Tools

Researchers from Zhipu AI and Tsinghua University released a technical paper on ChatGLM, a series of LLMs from Zhipu AI. The paper focuses on the GLM-4 series, which has been trained on 10 trillion tokens and 26 languages in total. GLM-4 demonstrates competitive performance against GPT-4, particularly in Chinese language tasks, and includes capabilities for autonomous tool usage.

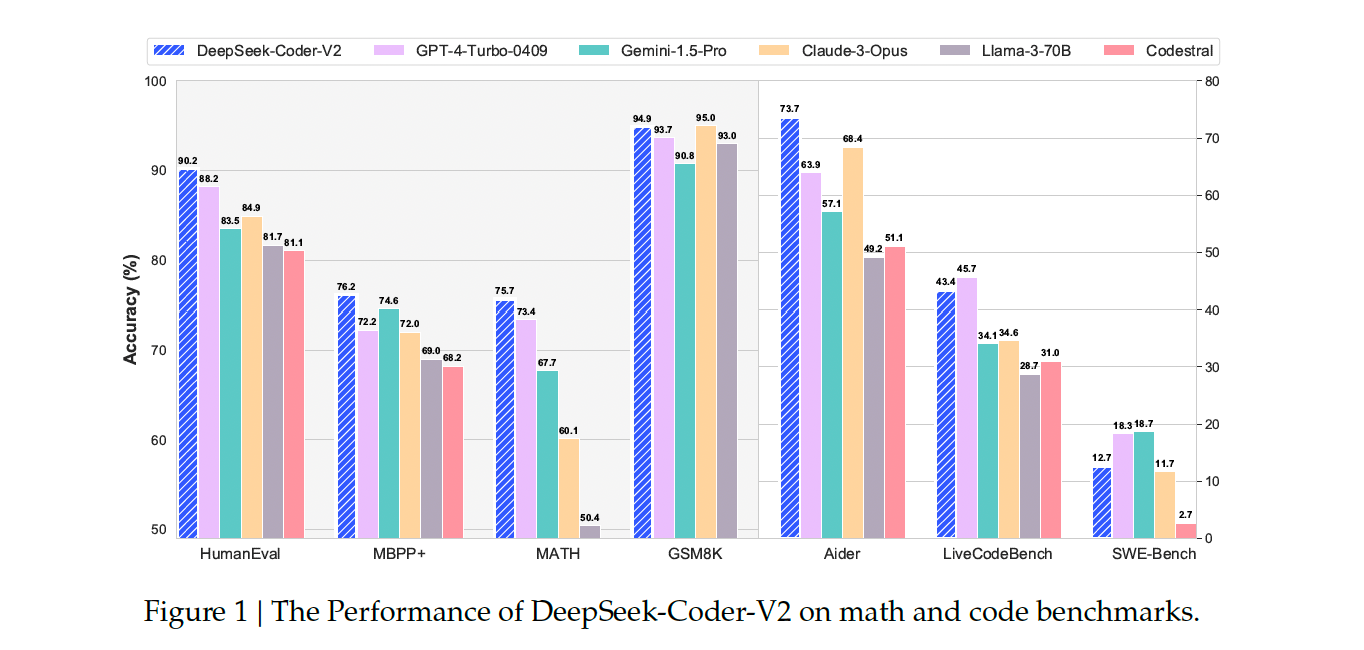

DeepSeek-Coder-V2: Breaking the Barrier of Closed-Source Models in Code Intelligence

Researchers from DeepSeek-AI presented DeepSeek-Coder-V2, an advanced open-source Mixture-of-Experts (MoE) code language model that has achieved performance comparable to GPT4-Turbo in code-specific tasks, with significant improvements in coding capabilities, language support, and context length.

Feel the AGI

China’s robotic startup Unitree shows off its new robot dog, Go2, a clone of Boston Dynamics’ Spot but costs only $1,600—40 times cheaper. To test its stability under extreme conditions, a human operator kicked the robot, hit it with a stick, and threw it away. Watch the robodog endure these tests, though it reminded me of a scene where Homelander takes revenge on scientists who tortured him as a child (kidding, just kidding).

The Ascend 910B challenges the A100 with its 256 TOPS of computing power, compared to the A100's 312 TFLOPS. Although the A100 has a slight numerical advantage, the Ascend 910B's performance in real-world applications is not to be underestimated.

In terms of memory, the Ascend 910B is equipped with 64GB of HBM2E, while the A100 offers 80GB of HBM2E.

Power consumption is an important metric for measuring chip efficiency. The Ascend 910B has a power consumption of 400W, while Nvidia's A100 is at 300W.

The core of technology lies in the details, and the Da Vinci architecture and Ampere architecture are the hearts of the Ascend 910B and A100, respectively.

The Da Vinci architecture is Huawei's self-developed AI computing architecture, designed to provide efficient AI computing capabilities. With 3D Cube matrix computing units, the Da Vinci architecture can complete a large number of MAC operations in a single clock cycle, accelerating AI computing tasks. In addition, the Da Vinci architecture also supports various precision calculations to meet the needs of different AI application scenarios.

The Ampere architecture, as Nvidia's latest GPU architecture, innovates in optimizing AI and HPC tasks. Ampere introduces new Tensor Cores and structured sparsity techniques, further enhancing the performance and efficiency of AI computing. At the same time, Ampere also strengthens support for Multi-Instance GPU (MIG), providing the possibility for multi-task parallel processing.