🍎Apple Partners with Alibaba, Baidu on AI, ERNIE 4.5 Goes Open Source, and 1B LLM Beats 405B in Math

Apple’s China-version AI features—Apple Intelligence—just got some intriguing updates. Its partners include Alibaba and Baidu.

Hi, this is Tony! Welcome to this issue of Recode China AI (for the week of February 11, 2025), your go-to newsletter for the latest AI news and research in China.

We’ve got a lot of news to cover this week: Apple’s China-version AI features—Apple Intelligence—just got some intriguing updates. Its partners include Alibaba and Baidu. The underlying mechanism is complex and I’ll do my best to explain. Meanwhile, Baidu, once a vocal critic of open LLMs, announced it will open-source its next-gen LLM, ERNIE 4.5.

On the research front, a 1B LLM outperforms a 405B model on math benchmarks, and ByteDance’s new video generator is stunning. Let’s dive in!

Apple Partners with Alibaba, Baidu to Develop AI Features for iPhones in China

What’s new: Apple’s iPhones sold in China will use Alibaba’s AI models, Alibaba Chairman Joe Tsai revealed during an interview at the World Government Summit in Dubai this week.

Apple has been very selective. They talked to a number of companies in China, and in the end they choose to do business with us. They want to use our AI to power their phones.

The announcement follows an exclusive story from The Information, which reported that Apple is partnering with Alibaba to develop its China-version Apple Intelligence, a personal AI system deeply integrated with Apple’s iPhones, iPad and Mac. The AI features have been submitted for approval by China’s cyberspace regulator. Without partnering with local companies, foreign companies—Apple included—won’t receive the necessary approvals to offer generative AI services to the public.

Later, Bloomberg confirmed that Apple Intelligence will launch in China as early as May 2025.

How it works: Previous reports from The Wall Street Journal and The Information last year suggested Apple had initially considered partnering with Baidu to roll out Apple Intelligence in China. However, that collaboration “hit snags” when Baidu’s models failed to meet Apple’s standards.

Apple also considered Tencent, ByteDance, Baichuan AI, and Moonshot AI before selecting Alibaba. The smartphone maker even passed on working with DeepSeek due to the company’s limited resources and lack of experience in supporting large-scale operations. Apple has not officially commented on the matter.

Despite the setback, Baidu remains involved. The Information reported that Baidu is supporting an AI-powered search feature for Apple that can handle images and text. The feature, known as Visual Intelligence, allows users to ask questions about items and retrieve information from the web. In the U.S., Visual Intelligence integrates ChatGPT and Google’s image search. It’s unclear whether Baidu’s AI will handle both roles or serve only as an image search tool. Baidu is also behind the upgraded Chinese version of Siri by enhancing its voice assistant with AI.

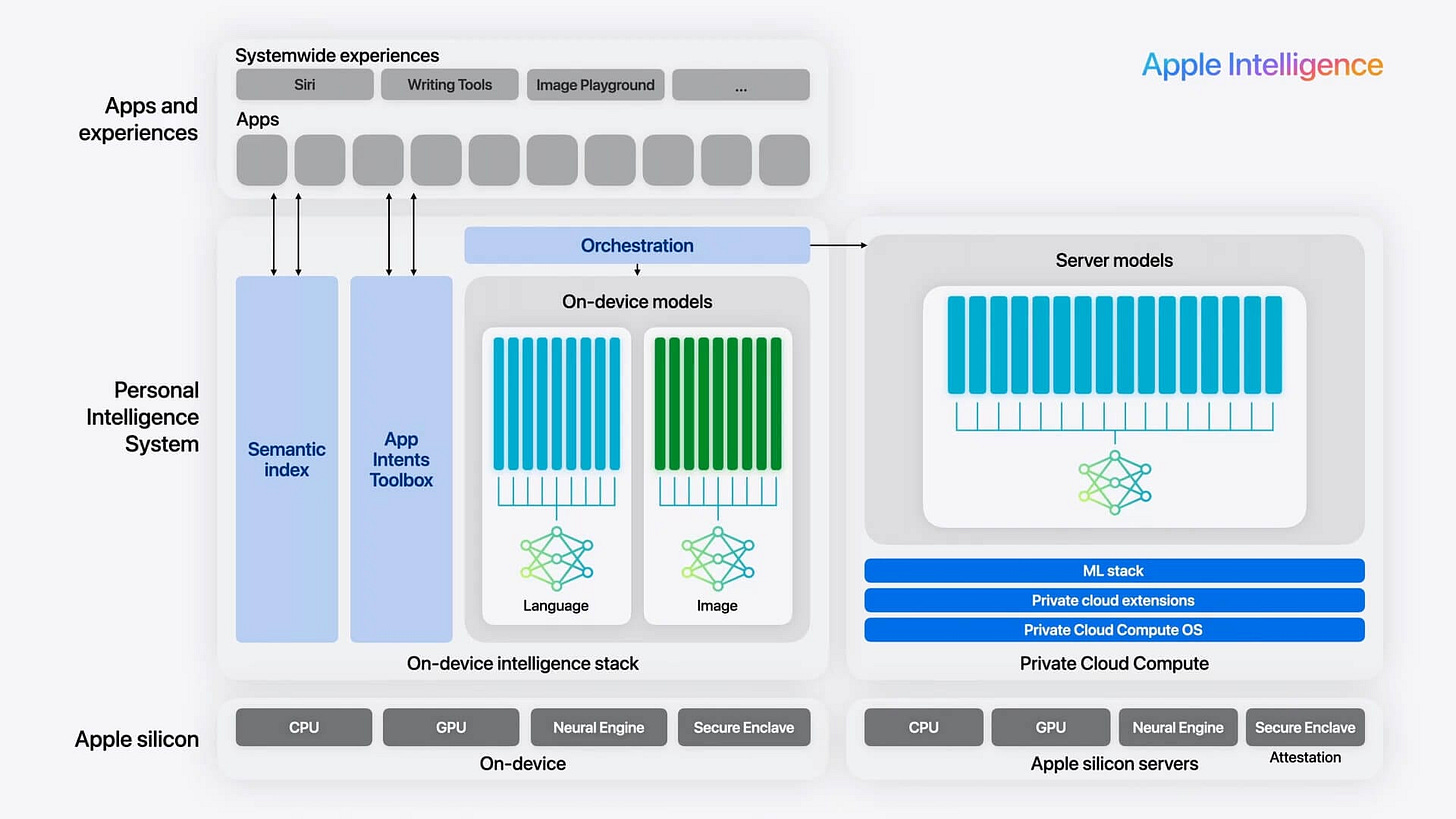

Apple Intelligence is a suite of AI-powered tools rather than a standalone app. It includes features like Rewrite, Proofread, and Summarize for text editing, an upgraded Siri with advanced NLP and multi-app actions, image generation, personalized emoji-like images, and a notification summary tool.

Many of these features rely on on-device AI models, which can run locally without any Internet connection. For more complex tasks, Apple will use server-based models on its Private Cloud Compute (PCC), where the user data will be processed but not stored or accessible to anyone. Apple has also integrated OpenAI’s ChatGPT into Apple Intelligence. For example, Siri can tap into ChatGPT for more contextual responses, while Apple’s writing tools can use it for text and image generation. These queries will be processed on cloud via API requests.

In China, Apple’s approach seems more complex. While Apple will continue using its on-device models, Alibaba’s AI models will act as an additional layer to censor content, according to Bloomberg. It remains unclear whether Alibaba’s models will also help process tasks on Apple’s PCC cloud servers.

Apple’s using its own LLMs is surprising but makes sense. According to a previous The Information report, Apple’s initial collaboration with Baidu stalled because Baidu wanted to store and analyze data from iPhone users’ queries. Apple’s privacy policies prohibit the collection of such data.

It’s unlikely that Apple’s user data will be shared with Alibaba to train a customized model. Apple’s own LLM is better suited to understanding typical iPhone user scenarios, while using Alibaba’s model as a “copilot” for content moderation tasks—a middle-ground solution.

Both The Information and Bloomberg did not specify whether Apple’s image generation feature will rely on its own AI models or third-party models.

Why Alibaba: Selecting Alibaba was a natural choice: Qwen is China’s leading LLM and highly popular among developers due to its open-source nature. Alibaba has released over 100 Qwen models of various sizes to meet different needs, ranging from a 1.5B-parameter model that can run locally to models exceeding 100B parameters. Alibaba’s cloud service is the market leader in China, offering the infrastructure necessary to support large-scale cloud-based computing.

However, Alibaba’s role in the partnership seems to be downplayed as Bloomberg framed its model primarily as a censorship layer. I believe the underlying complexity of this partnership may be greater than reported. There could be a few possible paths:

Apple’s LLM generates the raw output, and then Alibaba’s LLM checks or censors that output in a second step by rewriting or sanitizing certain terms/phrases.

A hybrid mode where Apple’s LLM handles the main conversation while Alibaba’s LLM specifically monitors the output in parallel.

A router mode based on the prompt. For non-sensitive queries, Apple uses its on-device LLM. For queries that might brush against local policy, Apple hands the prompt to Alibaba’s LLM to generate a “safe” version.

Why it matters: Apple faces declining sales in China, its largest market outside the US, where local smartphone brands like Huawei and Xiaomi have gained market share. In the December quarter of 2024, Apple’s sales in China dropped by 11.1% year-over-year, marking the sixth consecutive quarter of declining sales in the country.

Analysts see the launch of Apple Intelligence in China as a key opportunity for long-awaited growth. Wedbush Securities estimates that more than 100 million of the roughly 200 million iPhones in China are due for an upgrade.

Equally significant is whether AI features co-developed by Apple and Alibaba will receive regulatory approval in China. If approved, it could open the door for foreign companies to offer generative AI services in China with their proprietary models—so long as they work with local partners to comply with content moderation requirements.

Baidu to Open Source ERNIE 4.5 and Offer Free Chatbot in Bid to Reclaim AI Leadership

What’s new: In just five days, Baidu made its ERNIE Bot chatbot free, unveiled a new Deep Search feature, and announced that it will open source its ERNIE 4.5 model series from June 30, 2025.

These developments thrust Baidu back into the spotlight after the company’s leadership in China’s AI race faded in 2024, especially with challengers like DeepSeek, Alibaba’s Qwen, and ByteDance’s Doubao gaining momentum. Adding to the buzz, Baidu also reportedly plans to release ERNIE 5.0, its next-gen multimodal foundation model, in the second half of 2025.

Why open-sourcing: The most significant shift is Baidu’s decision to embrace open-sourcing—a move that didn’t come easily. Baidu CEO Robin Li has been a vocal critic of open-source LLMs. He once remarked that open LLMs will always lag behind closed-source models.

Li’s strong stance in favor of closed models was backed by evidence. Since the release of ChatGPT, closed-source models have maintained a consistent edge in performance, though the gap with open LLMs has gradually narrowed. Closed models are also more secure and user-friendly, especially through API access. Given the massive early investments by developers like OpenAI and Baidu in training LLMs, it seemed logical to keep them proprietary and monetize them through cloud services.

However, as DeepSeek’s open-source models V3 and R1 match the performance of top frontier models such as Claude-3.5-Sonnet and o1 while running at a fraction of the cost, the value of closed models will be significantly diminished.

It raises a serious existential question for closed models: do they still have value? If closed models are expensive but don’t offer a clear performance advantage, why would anyone use them?

—Allen Zhu Xiaohu, a managing director of GSR Ventures.

Ironically, DeepSeek has proven that open-source models can still generate commercial returns. DeepSeek R1 is now supported by 44 companies and platforms in China. On the consumer side, DeepSeek’s chatbot has attracted over 20 million daily active users.

DeepSeek’s rise ultimately shifted Li’s perspective on open-source strategy.

Open source can help you gain more attention. If you open things up, a lot of people will be curious enough to try it. This will help spread the technology much faster.

The open-sourcing of the ERNIE 4.5 model series will likely follow a similar playbook—attracting developers and AI enthusiasts, boost brand recognition, and gather community feedback to improve future versions like ERNIE 5.0. Baidu has a history of open-sourcing, with earlier generations of its ERNIE models, the Apollo autonomous driving platform, and the PaddlePaddle deep learning framework all made freely available to the public.

Why ERNIE Bot is made free? When Baidu launched ERNIE 4.0 in October 2023—boasted as China’s first GPT-4-level model with over 1 trillion parameters—the company introduced a subscription model, charging $8 per month for access to ERNIE 4.0 through its ERNIE Bot. A less advanced version, ERNIE 3.5, remained free. This move mirrored OpenAI’s subscription strategy to partially offset high training costs.

However, ERNIE Bot’s subscription model didn’t achieve the commercial success of ChatGPT. While OpenAI projected $3 billion in revenue for ChatGPT in 2024 and $8 billion in 2025, Baidu never disclosed its subscription revenues. Meanwhile, other competing chatbots in China are offered for free. Without free access to its most advanced model, ERNIE Bot struggled to compete with rivals like ByteDance’s Doubao and Moonshot AI’s Kimi. The sudden rise of DeepSeek’s free chatbot accelerated Baidu’s challenges.

By making it free, Baidu hopes to boost user adoption, and better compete in the rapidly evolving AI market. It also aligns with broader reductions in inference costs related to computing power, which will make operations more efficient.

Trending Research

ByteDance’s Seed foundation model team introduced UltraMem, which has significantly lower memory access cost during inference compared to MoE. The team claimed under common inference batch sizes, it can be up to 6 times faster than MoE with the same parameters and calculations.

Can 1B LLM Surpass 405B LLM? Rethinking Compute-Optimal Test-Time Scaling

Researchers from Shanghai AI Lab claimed that using their compute-optimal test-time scaling strategy, extremely small policy models can outperform larger models. For example, a 1B LLM can exceed a 405B LLM on MATH-500. Moreover, on both MATH-500 and AIME24, a 0.5B LLM outperforms GPT-4o, a 3B LLM surpasses a 405B LLM, and a 7B LLM beats o1 and DeepSeek-R1, while with higher inference efficiency.

Goku: Flow Based Video Generative Foundation Models

Goku is a state-of-the-art family of joint image-and-video generation models leveraging rectified flow Transformers to achieve industry-leading performance.