Ant Group Losses AI Chief; Alibaba Introduces 10-Trillion Parameter Model; Pony.ai Reshuffles Self-driving Truck Business

China’s AI news in the week of November 14, 2021

Ant Group AI Chief Returns Academia

The once AI brain drain from academia to industry is seeing more frequent reverse migrations in the past year in China. This week, (Alan) Qi Yuan, former Chief AI Scientist and Vice President of Ant Group, the Chinese fintech upstart, and Alibaba's spinoff, has been confirmed to join the elite Fudan University as the Haoqing Distinguished Professor, according to Baidu Baike.

The master AI brain of Ant, Dr. Qi was building AI platforms and solutions to address various financial problems such as microlending, risk control, intelligent insurance, marketing, and customer service.

Before joining Alibaba and Ant in 2014, Dr. Qi obtained his Ph.D. from the Massachusetts Institute of Technology and a tenured associate professorship in Computer Science and Statistics from Purdue University. He previously served as an associate editor of the Journal of Machine Learning Research, the area chair of the International Conference on Machine Learning, and the conference chair of the Chinese Congress of AI. He received Microsoft's Newton Breakthrough Research award in 2008 and the USA NSF Career award in 2011.

Dr. Qi's departure is another bad news for Ant after its blockbuster US$35 billion IPO last year was scuttled by the government and lost almost two-thirds of its once $300 billion valuation estimates.

As Recode China AI previously reported, Chinese top tech companies have been losing their top brains. For example, ByteDance AI Chiefs Dr. Li Lei and Ma Wei-Ying have left to join the University of California at Santa Babara and Advanced Industry Research (AIR) at the elite Tsinghua University respectively. Other recent experts who exit the industry include Dr. Tong Zhang from Tencent's AI Lab and Dr. Jiaping Ye from Didi Chuxing's AI Lab.

Alibaba Unveils World's Largest AI Model with 10 Trillion Parameters

Six months ago, Alibaba introduced a cross-modal pretraining method called M6, referring from Multi-Modality to Multi-Modality Multitask Mega-transformer, for unified pretraining on the data of single modality and multiple modalities. Akin to OpenAI's Clip but in Chinese, the model can be applied to tasks like image captioning, text-to-image generation, language generation, and question answering. The research scaled the model size to 100 billion parameters, but they didn't stop from there.

During Singles' Day, the Chinese e-commerce shopping bonanza, Alibaba announced M6-10T, the 10 trillion-parameter version of M6. The model is 50 times larger than GPT-3 with significantly higher training efficiency - only 1 percent of energy consumption used to train GPT-3 under the same model size. In addition, the research team took 10 days to completer training with 512 V100 GPUs.

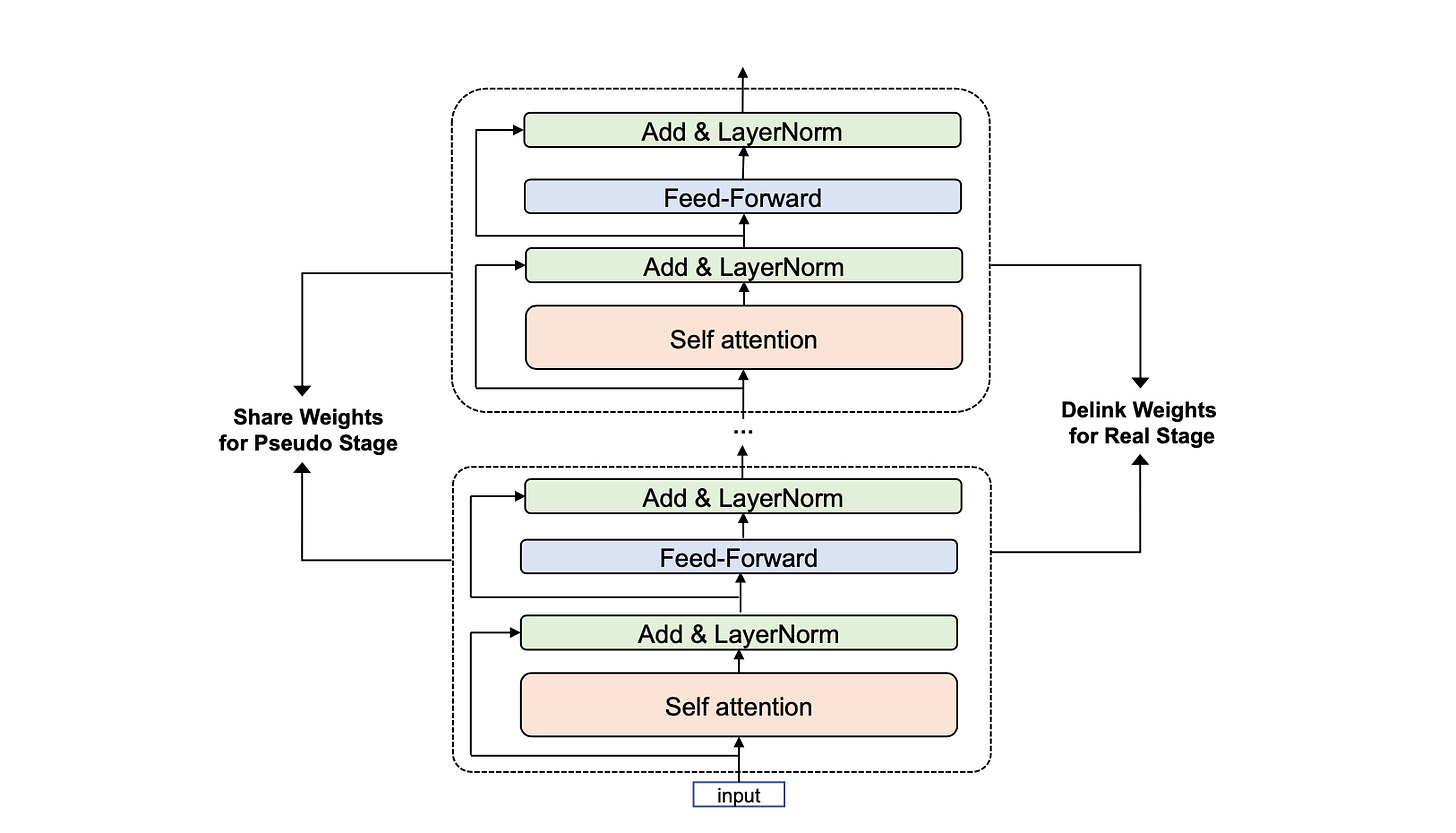

In the paper M6-10T: A Sharing-Delinking Paradigm for Efficient Multi-Trillion Parameter Pretraining, the research team proposed a simple training strategy called "Pseudo-to-Real" for high-memory- footprint-required large models. Instead of training an enormous model from scratch, this strategy consists of two stages:

First, researchers trained a model with many fewer parameters shared across layers, named Pseudo Giant, which was inspired by Cross-layer parameter sharing. With much fewer parameters, Pseudo Giant can be trained with large batches for acceleration.

Second, researchers trained a large model without cross-layer parameter sharing "Real Giant." Both Real Giant and Pseudo Giant share the same model structure. Each layer of Real Giant is initialized with the weights pre-trained in Pseudo Giant.

In addition to this strategy, researchers also used a faster offloading mechanism for both management of CPU memory for parameter storage and the utility of GPUs.

Alibaba's research wing Damo Academy said the M6-10T has been applied to Singles' Day for the first time, designing clothes for online stores and composing scripts for virtual e-commerce live-streamers.

Pony.ai Scales Back Autonomous Truck after US IPO Halted

Chinese autonomous driving unicorn Pony.ai has reportedly pressed on a brake to its promising autonomous trucking business after the US listing stuck in limbo and key executives departed, Chinese media Latepost reported.

About a month and a half ago, the Beijing-based company founded by former Baidu execs James Peng and Tiancheng Lou incorporated its standalone autonomous truck research team - including 100 people before the merge - into its robotaxi team. A swath of Pony.ai executives and top-tier experts, including the former head of autonomous truck tech and the director of planning & control, have left the company for new ventures. The company also suspends its autonomous truck road testing in the US.

Pony.ai announced its autonomous truck unit under the brand name "PonyTron" this March and received a freight transport permit from the Guangzhou government this May. Their trucks have shipped approximately 13,650 tons of freight, with a commercial operating mileage of 37,466 km in the first three months.

However, PonyTron stumbled upon a shortage of funding after Pony.ai's US listing plan to raise US$1-1.5 billion with a valuation of US$12 billion was suspended, Reuters reported this August. The company failed to obtain assurances from Chinese regulators that it would not become a target of a crackdown against Chinese tech. In an internal meeting, the company decided to shift its priority back to robotaxis.

Departed Pony.ai execs have subsequently created their companies related to the logistics business:

Qiangua Tech (千挂科技) was established this July and received funding from XPeng and SF Express. CTO Sun Haowen was the former head of P&C.

Xingxing Tech (行猩科技) was founded by the former head of Pony.ai fundraising Rachel Zhao aiming to design and manufacture electric truck with L2+ - L4 self-driving capabilities.

Qingtian Smart Truck (擎天智卡) was registered this November in Beijing. The company was founded by the former CTO of PonyTron.

Investment News:

Edge Medical Robotics, a Shenzhen-based surgical robot platform, has raised over $200 million in its Series C funding round led by Boyu Capital and jointly led by Temasek and Sequoia China. Known as China's rival to Da Vinci Surgery, the four-year-old company focuses on developing and commercializing robots for minimally invasive surgery.

Gaussian Robot, a Shanghai-based smart cleaning robot company, has CN ¥1.2 billion (US$188 million) in its Series C funding round from Capital Today, SoftBank Vision Fund 2, Meituan, and others. Founded in 2013, the company develops autonomous robots to automate cleaning tasks.

DeepGlint, a Beijing-based computer vision company, has received the green light to go public on the Shanghai Stock Exchange STAR market, China's Nasdaq. Founded in 2012 by Google veterans, the Sequoia-backed startup aims to raise CN ¥1 billion (US$156 million) to expand its AI footprint in smart finance, city management, and business retail. The company has reported its annual revenue of CN ¥51.96 million, CN ¥71.21 million, and CN ¥240 million for 2018, 2019, and 2020 respectively.