📕Alibaba's 110B Open Model, Tesla FSD to Join China's ADAS Race, and Xiaohongshu Develops its Own LLM

Weekly China AI News from April 29, 2024 to May 5, 2024

Hello readers, in this issue, I’ll discuss Alibaba’s new open model with 110 billion parameters. Tesla’s driver-assistance software FSD has reportedly received tentative approval for deployment in China. Additionally, Xiaohongshu is developing its own LLM, despite strategic investments in Moonshot and MiniMax, to bolster its AI self-reliance.

Alibaba Open Sources LLM With 110 Billion Parameters

What’s New: Alibaba last week released Qwen1.5-110B, its latest open-sourced LLM with 110 billion parameters. Qwen1.5-110B showcases performance on par with the Meta-Llama3-70B in base model evaluations, such as MMLU and GSM8K. In chat model evaluations, including MT-Bench and AlpacaEval 2.0, Qwen1.5-110B Chat outperforms Llama3-70B Instruct.

Technical Details: Qwen1.5-110B uses the same Transformer decoder architecture with grouped query attention (GQA) as previous models. This model supports a 32K token context length and is multilingual, including English, Chinese, Japanese, Spanish, German, and more.

The research team said the performance improvements in Qwen1.5-110B compared to the 72B model are attributed primarily to the increased model size.

What’s Next: The research team indicated that Alibaba is set to expand the capabilities of Qwen2.0 by increasing both the data and model size.

Remarkably, in less than three months, Alibaba has released a broad spectrum of models in the Qwen1.5 series, including models with parameters ranging from 500 million to 110 billion, specialized code models like CodeQwen1.5-7B, and hybrid expert models such as Qwen1.5-MoE-A2.7B.

Xiaohongshu Develops LLM to Increase AI Self-Reliance

What’s New: Chinese social media and e-commerce platform Xiaohongshu has recently tested its proprietary general-purpose AI model, “Little Sweet Potato (小地瓜)”, Chinese tech media reported. Spearheaded by its AI innovation head Zhang Debing, the initiative showcases Xiaohongshu’s strategic pivot towards AI-driven functionalities.

How It Works: Xiaohongshu’s foray into AI focuses on two main directions: multimodalities and AI content creation. The platform has introduced features like AI doodle and AI image pairing in its posting section as of July 2023.

Last September, Xiaohongshu started beta testing of a built-in assistant called DAVINCI, reportedly built on MiniMax’s abab model. Similar to Meta AI assistant, DAVINCI can chat with users regarding trip plans and purchasing suggestions.

Why It Matters: Xiaohongshu is the latest Chinese tech company that self-develops foundation models despite its strategic investments in Chinese AI unicorns like MiniMax and Moonshot. This signals a clear intent to remain adaptable in a rapidly evolving tech landscape.

Xiaohongshu’s incremental but cautious AI adoption also reflects a broader trend among Chinese tech firms integrating AI without disrupting the established user experience.

Tesla’s FSD Receives Tentative Approval, Joining China’s ADAS Battle

What’s New: During his short trip to Beijing, Elon Musk secured tentative approval from Chinese officials to launch Tesla's Full Self-Driving (FSD) driver-assistance software in China, multiple media reported. Tesla has also received clearance for data security and surveying & mapping qualifications, essential for smart driving systems. Tesla will deploy FSD using mapping and navigation data provided by Baidu.

Why Now: China's tentative approval is a significant win for embattled Tesla, whose first-quarter profits dropped to the lowest level. Expanding FSD to China's complex road scenarios will enrich Tesla’s AI training datasets.

China’s openness to FSD also signals its growing openness to cooperate internationally despite data security concerns. At the same time, FSD’s entry will likely spur domestic automakers and ADAS suppliers to accelerate their innovation.

Richard Yu, CEO of Huawei’s smart car solutions, recently said that Huawei engineers were sent to test the FSD system in the U.S. They concluded that Huawei’s system remains the best in the world. However, a Huawei-backed AITO M7 Plus last week rear-ended a water truck parked on a highway and caused three people’s deaths.

Major Players:

Automakers: XPeng, Li Auto, Nio

ADAS Suppliers: Huawei (with its new ADAS brand Qiankun 乾崑), DJI, Baidu Apollo, SenseTime Auto, Momenta, Mobileye, Bosch

Chip Makers: Nvidia, Horizon Robotics, Black Sesame, Texas Instruments

Weekly News Roundup

According to a recent report, China is now home to 369 unicorns, boasting an average valuation of US$3.8 billion, with AI and semiconductor companies leading the pack. Among 16 sectors, AI unicorns hold the highest average valuation at US$6.76 billion, closely followed by financial technology firms at US$6.57 billion. Beijing leads in unicorn creation with 114, while Shanghai and Shenzhen follow with 63 and 32 respectively. (SCMP)

According to new data from Georgetown University’s Center for Security and Emerging Technology, China surpasses the U.S. in leading research across more than half of AI’s most critical fields. (Axios)

Amidst the rapid advancement of generative AI, U.S. export restrictions significantly hinder China’s chip production capabilities, putting Chinese manufacturers at least five to ten years behind U.S. giants like Nvidia in developing advanced AI chips essential for cutting-edge AI technologies. (Nature)

Trending Research

StoryDiffusion: Consistent Self-Attention for Long-Range Image and Video Generation

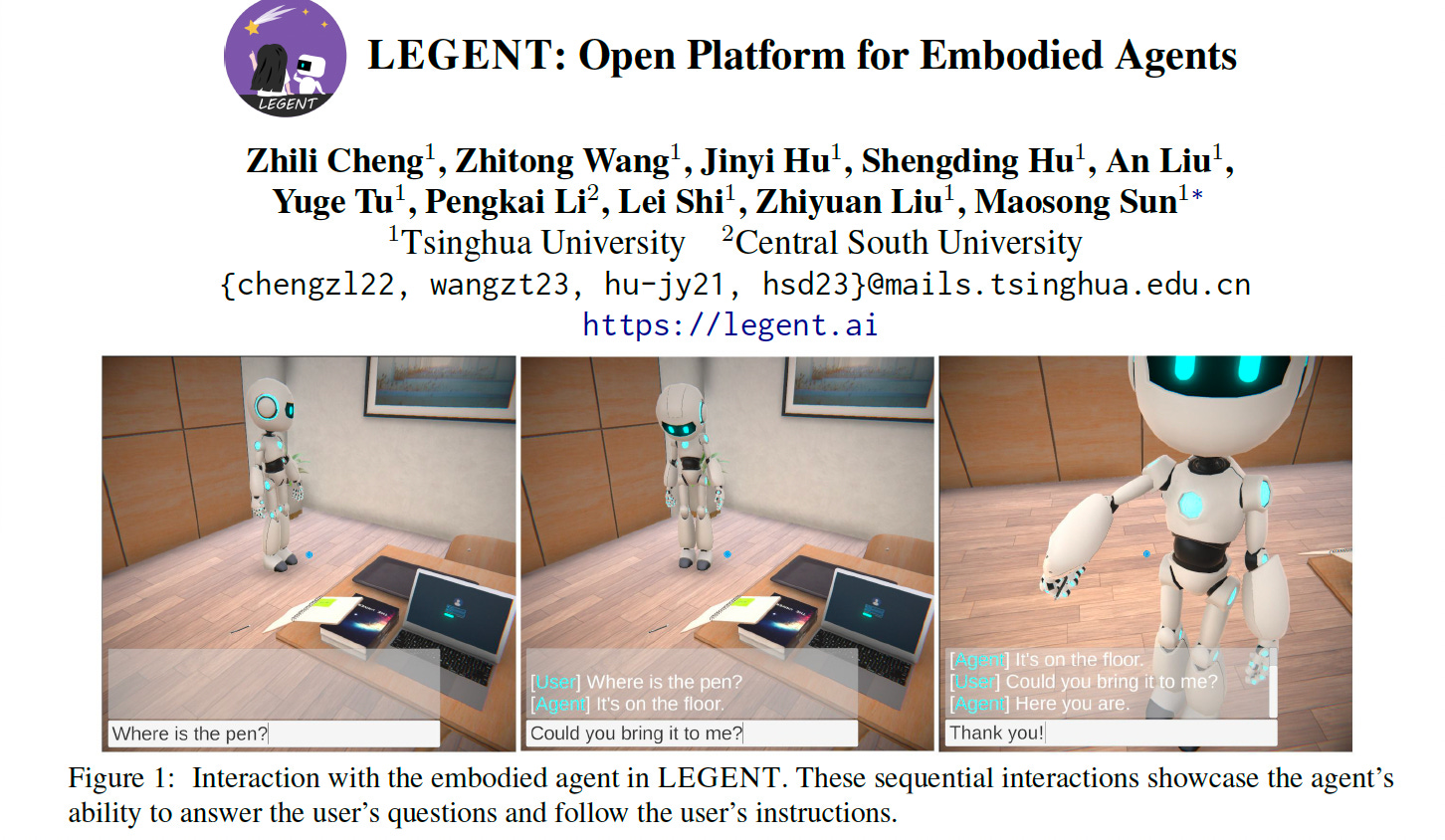

LEGENT: Open Platform for Embodied Agents

Understanding Emergent Abilities of Language Models from the Loss Perspective