🤺AGI vs. Application Priority Debate, China's AI+ Initiative, and Domestic Talent Boom

Weekly China AI News from March 4, 2024 to March 10, 2024

Hello readers, in this issue I discussed the most heated debate in China’s AI community last week: for AI startups, is it the right move to build LLMs from the ground or focus on application development? China’s Government Work Report proposed AI+ initiative for the first time. China sees domestic AI talent surge according to Marcopolo Research. Plus, a Chinese national who is a former Google engineer was charged for stealing over 500 AI trade secrets. He even showed up in a demo day to promote his startup while still employed at Google.

AGI or PMF: Chinese AI Community Debates Right Path

What’s New: In a recent interview with Tencent News, Allen Zhu, a renowned Chinese venture capitalist famous for his investments in Didi Chuxing and Ele.me, expressed his disinterest in investing in Chinese LLM startups. (Check out SCMP for a full coverage.)

This perspective contrasts sharply with that of Zhilin Yang, the founder of Moonshot AI, who has reportedly raised $1 billion from Alibaba and Hongshan, formerly Sequoia China. Yang champions the belief that AGI will be the most significant objective over the next decade. He prioritizes using AI to make a global impact over seeking product-market fit.

The divergent views of Zhu and Yang underscore the broader debate within China’s AI community regarding the focus of LLM startups: whether to prioritize commercialization and practical applications or to invest in the development of proprietary LLM technologies from scratch and pursue AGI.

Side-by-side: I highlighted their distinct views on key topics.

Views on LLM startups

Yang: Firmly optimistic about LLM entrepreneurship, considering AGI the only meaningful venture in the next decade, requiring long-term investment and perseverance with the ultimate goal of achieving AGI.

Zhu: Pessimistic about LLM entrepreneurship, believing that LLM companies don’t have scenarios and data are overvalued. “What if you spend $40-50 million on training GPT-4 and someone else releases it as open-source? Your investment would be wasted.” He prefers to invest in application-layer projects that can be commercialized and monetized quickly.

Views on Open-Source Models

Yang: Open-source models lag behind closed-source models. “The development approach of open-source models has already changed; it is now more centralized, and contributions may not be verified by computational power. Closed-source models might have more advantages.”

Zhu: For now, open-source is a generation behind non-open-source, but in the long run, open-source will definitely catch up as the technology iteration curve slows down.

Views on AGI

Yang: “AI is not about finding a Product-Market Fit (PMF) in the next one or two years, but about how to change the world in the next ten to twenty years.”

Zhu: “From a philosophical perspective, intellectual level upgrades require energy level upgrades. Without controlled nuclear fusion, I don’t believe Earth has enough computing power for true AGI. Reducing human work by 90% might be possible in 3 to 5 years, but the last 10% will require immense computing power and energy consumption.”

Views on the China vs US in LLMs

Yang: There won't be significant differences between China and the US in general capabilities, but differentiation in applications based on these capabilities is more likely.

Zhu: There is a significant gap between China and the US in the field of LLMs, with the US leading in underlying technology and China having advantages in application scenarios and data. Chinese entrepreneurs should focus on the domestic market first before considering expanding overseas.

Views on Model-First vs Application-First

Yang: “Applications might sound like you have a technology that you want to use somewhere, with a commercial closed loop. But applications complement AGI. It is both a means to achieve AGI and the goal of achieving AGI. If you only focus on applications now, well, you might get steamrolled in a year.”

Zhu: “The key is whether or not you can find a PMF. The skills for models and applications are entirely different; models need scientists, while applications require a deep understanding of scenarios, market deployment, and sales.”

Views on the Relationship Between Startups and Giants

Yang: Giants and startups differ in goals and strategies, but there is competition and cooperation between them.

Zhu: LLM startups might eventually be acquired by giants, but not at high prices, due to the severe homogenization of LLM and China’s anti-monopoly regulation.

Outlook on the Future

Yang: Optimistic about the future, believing AGI can advance human civilization to the next stage.

Zhu: Cautious about the future, considering the uncertainty of technological development, and thinks startups need to be more realistic and pragmatic.

Chinese Government Report Proposes “AI+” Initiative

What’s New: Chinese Premier Li Qiang, in the Government Work Report released last Tuesday, proposed the “AI+” initiative for the first time, aiming to deepen research and application in big data and AI.

How It Works: The AI+ initiative is part of a big plan to build a modern industrial system, accelerating the growth of so-called “new productive forces” with a significant push on digital economy innovation.

Why It Matters: “The AI Plus initiative will become a significant part in bolstering the high-quality development of the digital economy”, Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, told the Global Times.

Wei Kai, Deputy Director of the AI Research Center at the China Academy of Information and Communications Technology, told Chinese state media that AI+ is about integrating AI with specific industries and scenarios.

China’s national R&D spending exceeded 3.3 trillion yuan last year, marking an 8.1% increase from the previous year. Investment in basic research, a critical component of AI development, saw a 9.3% increase to 221.2 billion yuan.

China’s Surge in Domestic AI Talent Pool

What's New: Marcopolo Research’s Global AI Talent Tracker 2.0 reveals a significant expansion of China’s domestic AI talent pool in response to the booming local AI sector. The country’s share of the world’s top AI researchers climbed from 29% in 2019 to an impressive 47% in 2022.

How it Works: This growth is a testament to China’s strategic investment in AI education and research, leading to an increase in both the quantity and quality of its AI professionals.

China went from having no representation among the top 2% of elite AI researchers in 2019 (defined as authors of papers selected for Oral Presentations at NeurIPS) to holding a 12% share in this category by 2022.

Furthermore, when looking at the countries of origin for these elite researchers, based on their undergraduate education, China’s representation soared from 10% to 26% within the same period.

US Remains Attractive: The US remains the top destination for top-tier AI talent to work, according to the research. Over 36% of Chinese researchers who finished their undergraduate went to the US school for graduate programs, and almost 20% stayed and worked in the US.

Weekly News Roundup

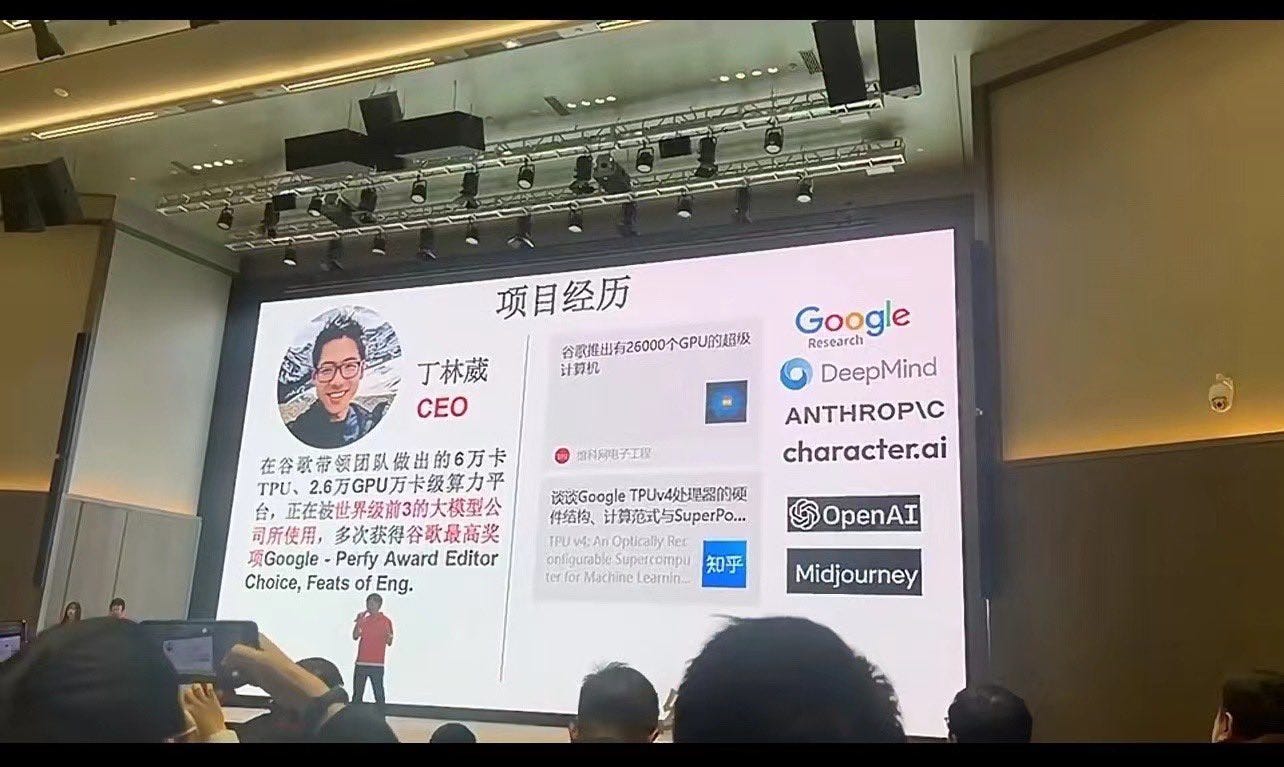

Ding Linwei, a Chinese national who is formerly an engineer at Google, was charged for allegedly stealing over 500 AI trade secrets to support his AI firms, facing up to 40 years in prison if convicted. (Wall Street Journal)

Since 2022, Ding served as CTO of a Chinese AI startup and established his own venture in 2023, all while employed at Google, as reported by Lianhe Zaobao.

Ding participated in the Fall Demo Day of MiraclePlus, formerly YC China founded by ex-Microsoft executive Qi Lu, where he claimed to be among the top 10 talents worldwide capable of connecting tens of thousands of GPUs.

Alibaba is leading a new investment round of $600 million in AI startup MiniMax, valuing the company at over $2.5 billion, as it continues to invest in Chinese LLM startups. (Bloomberg)

Alibaba has invested in China’s top LLM startups including Zhipu AI, Baichuan AI, 01.AI, Moonshot AI, and MiniMax.

Alibaba’s recent investment requires the invested startups to use part of the funding on Alibaba Cloud’s computational resources, a move that mirrors Google Cloud and AWS.

U.S. officials have informed AMD that its AI chip designed for the Chinese market requires a license due to export controls on advanced technologies, challenging AMD’s efforts to sell a lower-performing processor to China. (Bloomberg)

Trending Research

Yi: Open Foundation Models by 01.AI

PixArt-Σ: Weak-to-Strong Training of Diffusion Transformer for 4K Text-to-Image Generation